FACT SHEET: President Biden’s Cap on the Cost of Insulin Could Benefit Millions of Americans in All 50 StatesAs part of President Biden’s historic Inflation Reduction Act, nearly four million seniors on Medicare with diabetes started to see their insulin costs capped at $35 per month this past January, saving some seniors hundreds of dollars for a month’s supply. But in his State of the Union, President Biden made clear that this life-saving benefit should apply to everyone, not just Medicare beneficiaries. This week, Eli Lilly, the largest manufacturer of insulin in the United States is lowering their prices and meeting that call.

Eli Lilly announced they are lowering the cost of insulin by 70% and capping what patients pay out-of-pocket for insulin at $35. This action, driven by the momentum from the Inflation Reduction Act, could benefit millions of Americans with diabetes in all fifty states and U.S. territories. The President continues to call on Congress to finish the job and cap costs at $35 for all Americans.

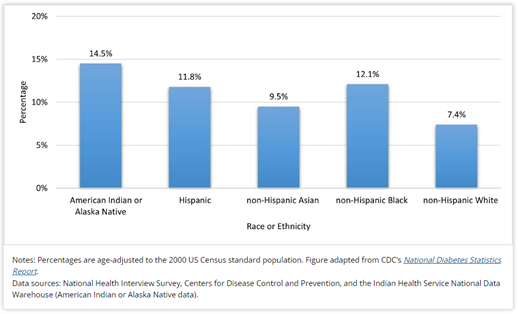

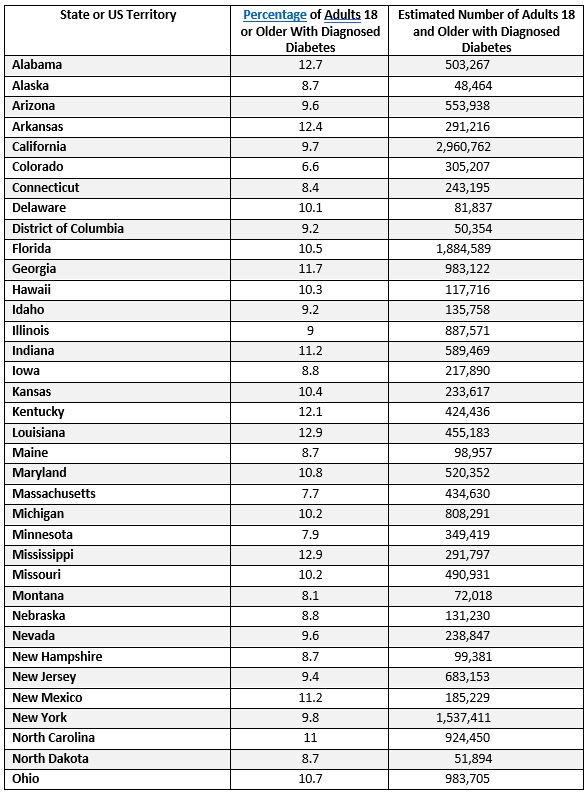

The below data breaks down how many adults are living with diabetes in each state, highlighting the cumulative number of adults that could experience lower insulin costs from the Inflation Reduction Act’s insulin cost cap for seniors, and industry’s follow-on actions. And, data shows that these cost-saving measures will disproportionately impact communities of color, as Black, Hispanic, and American Indian/Alaska Native adults have higher rates of diabetes in the United States than white Americans.

Additional information on how many seniors in each state are already benefiting from the President’s historic actions is available here from the Department of Health and Human Services.

Percentage of Adults Aged 18 Years or Older with Diagnosed Diabetes, by Racial or Ethnic Group, United States, 2018-2019 Estimated Number of Adults 18 and Older with Diagnosed Diabetes by State

Estimated Number of Adults 18 and Older with Diagnosed Diabetes by State *The estimates are developed from a base that incorporates the 2020 Census, Vintage 2020 estimates, and (for the U.S. only) 2020 Demographic Analysis estimates. The estimates add births to, subtract deaths from, and add net migration to the April 1, 2020 estimates base. For population estimates methodology statements, see https://www.census.gov/programs-surveys/popest/technical-documentation/methodology.html. See Geographic Terms and Definitions at https://www.census.gov/programs-surveys/popest/guidance-geographies/terms-and-definitions.html for a list of the states that are included in each region. All geographic boundaries for the 2022 population estimates series are as of January 1, 2022.https://www.whitehouse.gov/briefing-room/statements-releases/2023/03/02/fact-sheet-president-bidens-cap-on-the-cost-of-insulin-could-benefit-millions-of-americans-in-all-50-states/Biden budget would cap monthly insulin prices at $35 for people with private insurancePresident Joe Biden’s budget proposal would expand the $35 cap on monthly insulin prices to people who have private insurance.

*The estimates are developed from a base that incorporates the 2020 Census, Vintage 2020 estimates, and (for the U.S. only) 2020 Demographic Analysis estimates. The estimates add births to, subtract deaths from, and add net migration to the April 1, 2020 estimates base. For population estimates methodology statements, see https://www.census.gov/programs-surveys/popest/technical-documentation/methodology.html. See Geographic Terms and Definitions at https://www.census.gov/programs-surveys/popest/guidance-geographies/terms-and-definitions.html for a list of the states that are included in each region. All geographic boundaries for the 2022 population estimates series are as of January 1, 2022.https://www.whitehouse.gov/briefing-room/statements-releases/2023/03/02/fact-sheet-president-bidens-cap-on-the-cost-of-insulin-could-benefit-millions-of-americans-in-all-50-states/Biden budget would cap monthly insulin prices at $35 for people with private insurancePresident Joe Biden’s budget proposal would expand the $35 cap on monthly insulin prices to people who have private insurance.

The Inflation Reduction Act already implemented this cap for people on Medicare.

About 40% of people with diabetes have private insurance while 5% are not insured, according to the American Diabetes Association.

President Joe Biden’s federal budget proposal would cap insulin prices at $35 per month for people with private insurance plans.

The Inflation Reduction Act capped monthly insulin costs at that price for seniors in January, but left out everyone who wasn’t on Medicare. Biden called on Congress in his State of the Union speech to finish the job and cap insulin at $35 a month for everybody.

The price cap in the budget wouldn’t cover people who are uninsured. Health Secretary Xavier Becerra told reporters Thursday that the president believes nobody in the U.S. should pay more than $35 a month for insulin.

Becerra said one of the fastest ways to reduce insulin costs for the uninsured would be for the 10 remaining states that haven’t expanded Medicaid to do so. Medicaid is the public health insurance program for lower-income individuals.

Drugmaker Eli Lilly got ahead of a potential federal mandate, announcing earlier this month that it would cap insulin at $35 per month for people with private insurance at certain retail pharmacies. But CEO David Ricks, in a statement, said 7 out of 10 Americans do not use Lilly’s insulin. He called on federal policymakers and employers to help make the costs of the injections more affordable.

Biden praised Lilly’s decision and called on other manufacturers to follow suit. He also reiterated his call for Congress to lower insulin prices for everyone else.

About 40% of people with diabetes have private insurance while 5% are not insured, according to the American Diabetes Association.

Some Republicans in Congress oppose the move to cap insulin prices. Rep. Cathy Rodgers, who chairs the House Energy and Commerce Committee, called the Biden administration’s efforts to lower insulin prices as “socialist” and a “federal mandate” that is bad for market competition.

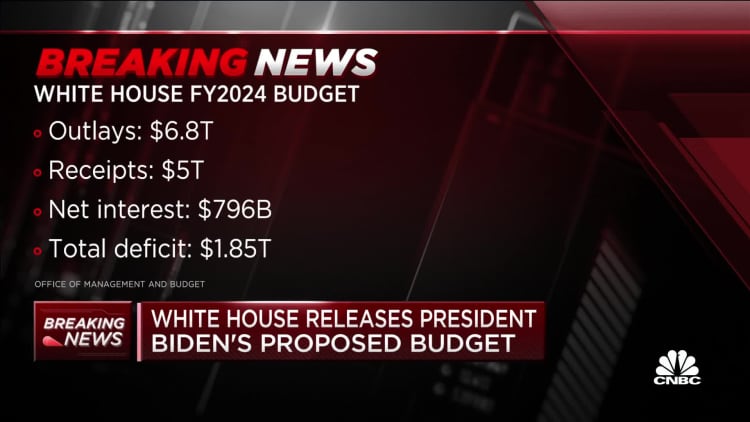

https://www.cnbc.com/2023/03/09/biden-budget-would-cap-monthly-insulin-prices-at-35-for-people-with-private-insurance-.htmlBiden budget would cut deficit by $3 trillion over next decade with 25% minimum tax on richest AmericansBiden’s budget would also raise more revenue by increasing taxes on oil and gas companies, hiking the corporate tax rate to 28% from 21%, and allow Medicare to negotiate drug prices.

The president’s spending priorities include increasing funding for early childhood education and child care, expanding the $35 cap on insulin prices to all Americans and expanding free community college.

The budget also boosts military spending to more than $835 billion, making it among the largest peacetime expenditures in U.S. history.

Biden still faces the unresolved standoff with Republicans over whether to lift the debt ceiling.

President Joe Biden released his budget on Thursday, vowing to cut $3 trillion from the federal deficit over the next decade, in part, by levying a 25% minimum tax on the wealthiest Americans.

Biden’s budget would also raise more revenue by increasing taxes on oil and gas companies, hiking the corporate tax rate to 28% from 21% imposed under former President Donald Trump but below the pre-2017 35% tax, and allow Medicare to negotiate drug prices.

With Biden likely to run for reelection in 2024, his budget is also a preview into his platform as a candidate and campaign pitch in the year ahead. Facing a Republican-controlled House, it’s unlikely many of the proposals will be passed in their current form. The president submits his budget to Congress outlining the administration’s priorities for the upcoming year, but ultimately Congress decides where the funds are allocated.

Fair shareWhite House Office of Management and Budget director Shalanda Young told reporters the administration is able to cut deficit spending “by asking the wealthy and big corporations to begin to pay their fair share and by cutting wasteful spending on Big Pharma, Big Oil and other special interests.”

“It does this in part by reforming our tax code to reward work, not wealth, including by ensuring that no billionaire pays a lower tax rate than a teacher or firefighter and by quadrupling the tax rate on corporate stock buybacks,” Young said. “That’s a very clear contrast with congressional Republicans.”

The Stock Buybacks Tax builds upon a measure Biden signed into law last year reducing the differential treatment in the code between buybacks and dividends. The goal is to encourage business to invest in growth rather than spending on stock buybacks. Under the budget proposal, the tax would quadruple from 1% to 4%. A Data for Progress poll from February found 58% of Americans support increasing the stock-buyback tax.

Biden’s fiscal year 2024 budget gets some help from the slowing Covid-19 pandemic, which the White House noted needs less emergency aid as the outbreak enters a new phase thanks to widespread vaccinations. The president’s spending priorities include increasing funding for early childhood education and child care, expanding the $35 cap on insulin prices to all Americans and expanding free community college. These proposals are all part of his push to give American families “a little more breathing room.” The 2024 fiscal year begins Oct. 1 and runs through Sept. 30, 2024.

Social programsCecilia Rouse, chair of the Council of Economic Advisers, explained how the administration believes the social programs outlined in the White House budget will actually boost the economy.

“Policies such as paid leave and child care will bring more workers into the labor force and improve productivity,” Rouse said. “Investments in early education, mental health and community college not only expand our economy’s productive capacity but pay dividends for generations to come.”

In addition to social spending, the budget includes robust defense funding. At more than $835 billion, the defense budget would be among the largest peacetime expenditures in U.S. history.

For weeks the president has urged House Republicans to present their own budget proposals instead of just criticizing his plan. House Republicans have promised to propose a balanced budget and have scoffed when the White House pointed to GOP proposals to make cuts to programs like Social Security and Medicare. House Budget Committee Chair Jodey Arrington told CNN on Wednesday the Republican budget should be ready by the second week in May.

‘Fight it out’Speaking in Philadelphia, Pa. on Thursday, Biden said he and House Speaker Kevin McCarthy, who the president noted is “a very conservative guy” with “a very conservative group” of lawmakers, agreed early on to meet after they both introduce their budgets.

“We’ll sit down and we’ll go line by line, and we’ll go through it and see what we can agree on, what we disagree on, and then fight it out in the Congress,” Biden recounted telling McCarthy. “I’m ready to meet with the Speaker anytime, tomorrow if he has his budget. Lay it down, show me what you want to do, I’ll show what I want to do. We can see what we can agree on, see what we don’t agree on and we vote on it.”

The White House, in its budget proposal, includes an entire section dedicated to shoring up Social Security and Medicare, funded by the minimum 25% wealth tax on households with a net worth of $100 million or more. The proposed budget would extend “the solvency of the Medicare Trust Fund by at least 25 years” without removing benefits or raising costs. It also provides a $1.4 billion increase in funding for Social Security to improve services.

Debt ceiling debate“Benefit cuts are not on the table,” Young said.

Looming over the budget release is the unresolved standoff over whether to lift the debt ceiling. The White House has maintained it will not negotiate over the debt limit, arguing Congress should act to raise it as it has done numerous times over past decades. House Republicans, led by Speaker Kevin McCarthy, have tried to tie the debt ceiling to future spending, saying they will not budge without promises to cut expenses. The debt ceiling, however, pertains to existing spending. To date, House Republicans have been murky on what expenses they would like to see cut.

“MAGA Republicans in Congress have tried to repeal the Affordable Care Act, Social Security, Medicare, Medicaid — we’re not going to let them folks,” Biden said. “My budget makes robust investments on military defense, let’s see what the MAGA Republicans propose and let’s be clear where I stand: I will not allow cuts to the needs of the intelligence community or military that help keep us safe.”

‘Back to work’Rouse touted the administration’s economic track record, noting that unemployment has fallen somewhat inexplicably under Biden’s watch — even as the pace of inflation has slowed. She said most economists couldn’t have predicted the jobs market would rebound as strongly as it has since he took office.

“I think if you told most conventional macroeconomists last June that we were about to get seven straight months of declining annual CPI inflation, they would have told us that the unemployment rate would rise over that time, but instead the unemployment rate in January was 3.4%, or 0.2 percentage points lower than it was,” Rouse said, noting that February’s unemployment rate will be released Friday. “The economy looks healthier today than it did in other ways, too.”

Rouse expanded on that, in an attempt to ease recession concerns by pointing to economic gains already seen under the administration’s watch.

“The strength of our recovery has put us on solid ground to weather economic shocks,” Rouse said. “Americans are back to work and the economy is stronger than anyone, including the federal government and private forecasters, imagined it would be when President Biden took office.”

https://www.cnbc.com/2023/03/09/biden-budget-would-cut-deficit-by-3-trillion-over-next-decade-with-25percent-minimum-tax-on-richest-americans.html