The simple fact is, no other President in history has done more for job creation and manufacturing than President Biden and he's only a little over 2 years into his first term.

Nearly 13 million new jobs have been created including nearly 1 million new manufacturing jobs.

Thanks to President Biden's investment in America with the Inflation Reduction Act and Chips Act, tens of billions of dollars are being poured into new projects which is creating thousands of new jobs in small towns and suburbs all across America.

Also because of President Biden's policies, new plants and factories are being built all across America, which is bringing an economic boom to local communities. One other important factor is that people are not having to relocate for work due to an abundance of new job openings and factories that are nearby.

Let's not forget that Republicans in Congress all voted against the Inflation Reduction Act and Chips Act. They spent their time trashing President Biden and Democrats for passing this historic legislation that's putting United States #1 in the world. They said it was "woke agenda" and "won't do anything for job creation". They were all wrong again.

The people benefiting most from President Biden's policies are Republican voters in red districts who are getting the majority of these projects in their communities. Their own Republican congressmen and Senators voted against their own constituents' well being. These Republican voters should be thanking President Biden and Democrats for looking out for them by giving them good paying jobs and helping their communities flourish. Why on Earth would they ever be voting for a Republican when they don't do anything for them?

If it was up to Republicans, we never would be having this record job creation or manufacturing boom. We still would be in the same economic disaster that Donald Trump put us in along with his manufacturing recession. But thanks to President Biden, those days are long gone, and even right wingers can no longer try to criticize President Biden's policies because their red districts are feeling the Biden manufacturing boom.

The fact is, Democrats are better at managing the economy and with job and manufacturing creation. History has proven it and we are seeing history being made in these last 2 years thanks to President Biden's policies.

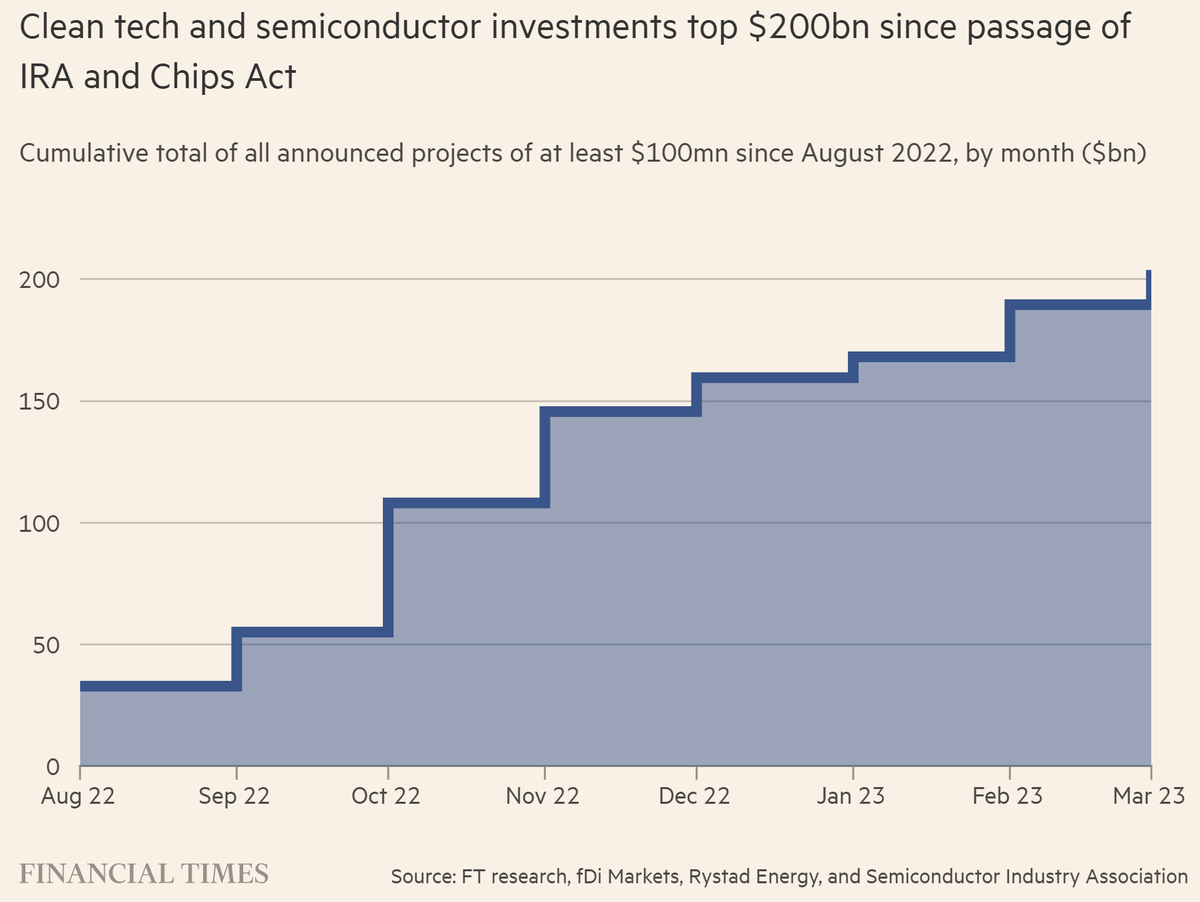

'Transformational change’: Biden’s industrial policy begins to bear fruitFT research shows commitments of more than $200bn to US manufacturing since IRA and Chips Act

The US appears poised for a manufacturing boom as companies tap into Biden administration subsidies with pledges to spend tens of billions of dollars on new projects, according to Financial Times research.

The Chips Act and the Inflation Reduction Act, passed within days of each other last August, together include more than $400bn in tax credits, grants and loans designed to foster a domestic semiconductor industry and clean-tech manufacturing base. The package was aimed at countering China’s dominance in strategic sectors such as electric vehicles and recapturing jobs from abroad.

The FT identified more than 75 large-scale manufacturing announcements in the US since the passage of these two industrial policies. Here is what we learned.

Semiconductor and clean energy projectsCompanies have committed roughly $204bn in large-scale projects to boost US semiconductor and clean-tech production as of April 14, promising to create at least 82,000 jobs. While not all these projects were a direct result of the passage of these bills, they will probably be eligible for the tax credits. The amount is almost double the capital spending commitments made in the same sectors in 2021 and nearly 20 times the amount in 2019. While the FT identified four projects worth at least $1bn each in the semiconductor and clean-technology sectors in 2019, we found 31 of that size after August 2022.

Semiconductors, electric vehicles and batteries captured the bulk of investment. The FT identified 21 semiconductor-related investments and more than three dozen projects aimed at boosting the US electric vehicle supply chain.

Taiwan Semiconductor Manufacturing Company’s $28bn expansion in Phoenix marks the largest investment to date, bringing the company’s total investment in its Arizona fabrication plants to $40bn, the biggest foreign direct investment project in US history.

The FT looked at projects involving capital investment of at least $100mn since the Chips Act and IRA were passed. We included projects aimed at boosting manufacturing in the semiconductor, electric-vehicle, battery and clean-energy sectors. Our analysis was based on company and government announcements and drew on data from fDi Markets, Rystad Energy, Wavteq and the Semiconductor Industry Association.

The IRA included $369bn worth of tax credits, grants and loans for clean-tech development, with bonus credits for projects paying prevailing wages or located in fossil-fuel communities. The credits can be accumulated, accounting for about 50 per cent of costs for some projects, say accountants. The Chips Act provides $39bn in funding for semiconductor manufacturing as well as $24bn worth of manufacturing tax credits.

“The industrial policy that’s being put into place hasn’t been seen for generations,” said Scott Paul, president of the Alliance for American Manufacturing. “This is a generational, transformational change that we’re seeing in America and our productive capacity.”

Republican districts are winning projectsMore than 75 per cent of all investment is headed to Republican-held Congressional districts, where it will create 58,000 jobs, according to FT data.

The surge in spending pledges in Republican areas comes despite the GOP’s votes against both the Chips Act and IRA in Congress. Some in the party remain critical of the legislation.

“I wish that we would be more specific and more calculated in our efforts,” said John Curtis, a Republican representative for Utah and founder of the Conservative Climate Caucus. Curtis declined to say whether he supported or opposed the legislation.

Republican congressional districts have secured far more investmentSenior Democrats are working to gain political credit for the jobs promised by the spending pledged since the industrial policies were passed last year.

Earlier this month, US vice-president Kamala Harris toured Hanwha Qcells’ solar factory in Dalton, Georgia, a district represented by the far-right Republican Marjorie Taylor Greene. Harris announced that the South Korean manufacturer would build the largest community solar project in the US, on top of its $2.5bn expansion announced in January.

“It’s going to be harder for Republican lawmakers to say these policies aren’t effective or aren’t worth it because they’re seeing jobs being produced in their communities,” Paul said.  Over $200bn in green tech and semiconductor investments have been announced since the passage of President Biden's Inflation Reduction Act & Chips Act.Foreign investors want a stake — including China

Over $200bn in green tech and semiconductor investments have been announced since the passage of President Biden's Inflation Reduction Act & Chips Act.Foreign investors want a stake — including ChinaAbout a third of all investments announced since August involve a foreign investor, with nearly two dozen projects coming from companies headquartered in Japan, South Korea and Taiwan. This includes LG Energy Solution’s $5.5bn proposed project in Arizona, announced in March, the largest battery investment ever in the US.

Analysts say these investments from the US’s Asian allies are also attempts to diversify away from dependence on China’s supply chains.

“Their strategic calculations here are somewhat similar to the United States’, in that China is the largest economy in their region but it’s also an economy with which they have somewhat tense security relationships,” said Cullen Hendrix, a senior fellow at the Peterson Institute for International Economics.

But Chinese investors are also vying for a stake in the US supply chain. While the Chips Act and the IRA have anti-China clauses, the US government is yet to rule on the extent to which Chinese companies can participate in building US facilities.

Two other large deals announced since August, both in Michigan, are Ford’s $3.5bn battery plant using technology from CATL, China’s battery giant, and a $2.4bn battery plant being built by a subsidiary of China’s Gotion. Both Chinese companies have been accused by some Republicans of being fronts for the Chinese Communist party. Virginia governor Glenn Youngkin rejected a proposal for the Ford project to be based in his state, telling TV reporters that it was a “Trojan horse”.

“There is no Communist plot,” said Chuck Thelen, North American vice-president of Gotion at a local town meeting. “The fact is we already live in a global industry, and to bring a Chinese manufacturing or a multinational manufacturing site into North America is the onshoring that our past president really promoted.”

CATL did not respond to a request for comment.

'A race to the bottom’The competition is fierce to win the largest manufacturing projects, with states doling out historic incentive packages to secure investments.

Of the spending commitments tracked by the FT, less than half — or about $80bn — disclosed the size of the subsidies they will receive from state and local authorities, on top of the credits available in the IRA and Chips Act. The total size of the subsidies for those that did disclose them amounted to $13.7bn.

The largest disclosed incentive package was $5.5bn given to Micron for its $20bn semiconductor fab in Clay, New York, helping the state beat Texas to the project.

“We gave every penny that we could give, and New York literally offered billions of dollars that we could not keep up with,” said Texas governor Greg Abbott in February.

The subsidy race has raised concerns among watchdogs over whether the projects will deliver economic benefits to the community.

Greg LeRoy, executive director of Good Jobs First, called the competition among states a “race to the bottom”. Because negotiations are rooted in secrecy, companies can convince states to give out larger packages even if they were intending to site in the state all along.

“We’re all in favour of green jobs. We’re all in favour of saving the planet. We’re not in favour of busting the budget to do that,” said LeRoy. Last year set an all-time record for billion-dollar subsidy packages, according to the research group.

https://www.ft.com/content/b6cd46de-52d6-4641-860b-5f2c1b0c5622